It does not affect the decline in credit rating when making a provisional inquiry. If you want an advantageous product suitable for your current situation, please contact us and proceed with it based on accurate information. Even if it is the same product, the better the credit is, the lower the interest rate is. Usually, you have to maintain a credit score of 530 or more, but some financial companies have to maintain a credit score of 700 or more based on Nice to proceed

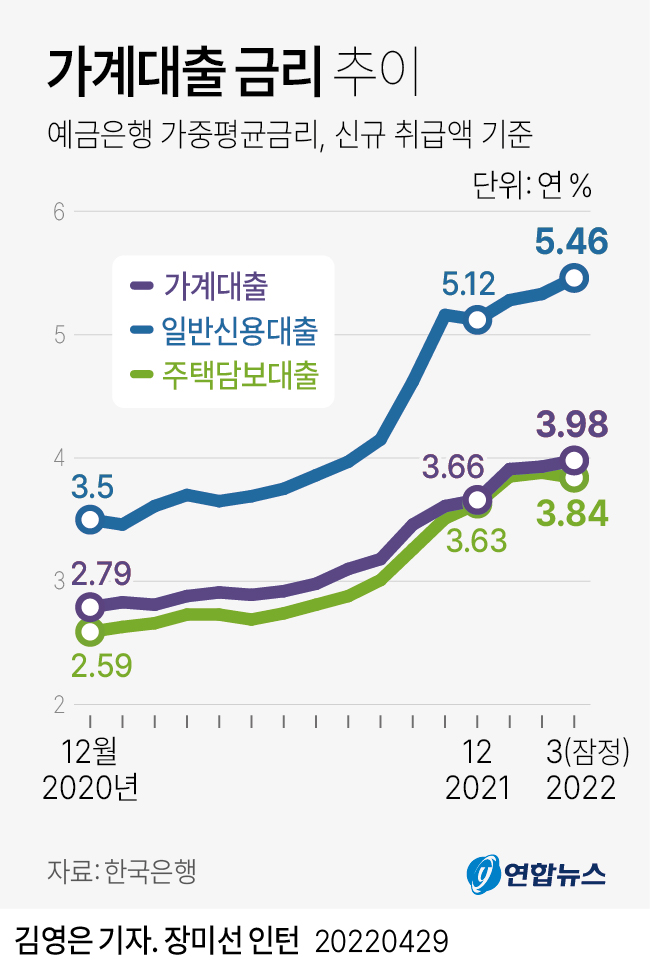

If you find a comparative calculation of apartment mortgage interest rates by bank?Also, interest rates on products vary for each financial company, but they are constantly changing depending on the situation, and when special products are released, there are cases where they can be used at a lower price than existing products, so it’s always good to check all the conditions and proceed with them. Also, even if the same interest rate is applied, the amount spent every month varies depending on the repayment period and method, so you have to consider this as wellThere are a lot of things that need to be selected and compared, such as the type of bank, type of house, interest rate, repayment method, amount, and period of 4~7% of LTV 60% of LTV/ DSR 40% of financial companiesIf you are looking for a comparative calculation of apartment mortgage interest rates by bank? If you do it, you can see that there is a lot of difference compared to last year. Although it is known that it is usually possible to proceed in the first financial sector, there are not many people who can actually use subordinated products in the first financial sector due to various conditions. So most of those who need funds in the second financial sector, consumer finance, or P2P have been using the method of raising funds through the second financial sector, consumer finance, or P2P. Let’s come up with an alternative by comparing the limited interest rates quickly and honestly according to the purpose of use!No matter how low a financial company can set interest rates, it is impossible to proceed if the borrower’s credit score is low. Usually, if you use an apartment mortgage rate comparison product in the second financial sector, it is often approved at an annual interest rate of 5% to 6%, and the interest rate approved in this way depends on the borrower’s credit score and the LTV of the financial company. Of course, LTV is set by each financial company, so it is not what we can do, and the choice of financial company depends on the borrower’s credit score, so I recommend that you do credit management as much as possible before proceedingIn the comparative calculation of apartment mortgage rates by bank, the second financial sector is mainly conducted by businesses, so office workers and freelancers often have difficulty, but that is not impossible, so you should look at various places as much as possible to find favorable conditions. The comparative calculation of apartment mortgage rates by bank and the products of the second financial sector vary in interest rates and financial companies that can proceed depending on the borrower’s credit score. So if you want to proceed, it is better to focus on ways to raise your credit score even a little in advance